Back to News

Back to News

October 31, 2022

The Tide is Turning Against ‘Woke Capitalism’

On Tuesday, Oct. 18th, Missouri Attorney General Scott Fitzpatrick divested $500 million in assets managed by the massive investment management firm BlackRock on behalf of the Missouri State Employees’ Retirement System (MOSERS). AG Fitzpatrick criticized BlackRock’s blind commitment to environmental, social, and governance (ESG) principles, noting that “fiduciary duty must remain the top priority for investment managers—a duty some of them have abdicated in favor of forcing a left-wing social and political agenda that has failed to succeed legislatively, on publicly traded companies.”

A relatively new group, the State Financial Officers Foundation (SFOF), has also taken action against ESG-obsessed investment management firms and strategies. South Carolina’s Treasurer Curtis Loftis announced in October 2022 he was divesting $200 million of BlackRock holdings by the end of the year. Louisiana’s treasurer John Schroder told Financial Times that he would divest $794 million from BlackRock as well. Additionally, Utah and Arkansas committed to pull $100 million and $125 million, respectively, from BlackRock over concerns that the firm prioritizes ESG principles over sound fiduciary management of state funds.

Utah’s State Treasurer Marlo Oaks said, “We need to ensure that the money is not being used to drive a separate agenda different from our obligation” to maximize benefits to Utah residents, not left-wing climate agendas.

Legal Look

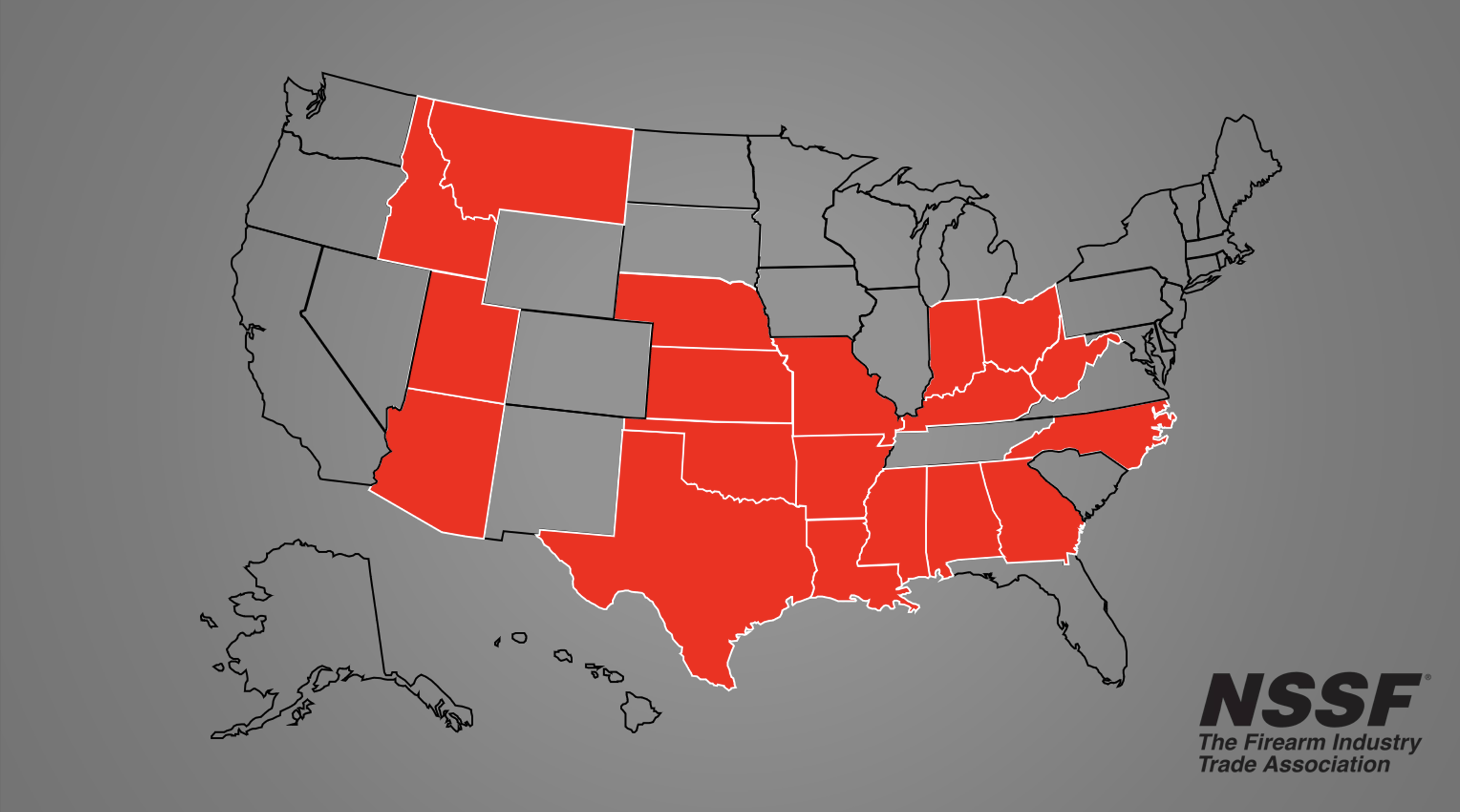

The ESG pushback doesn’t end there. In early August, 19 state attorneys general (AG) sent a joint letter to BlackRock CEO Larry Fink voicing similar concerns that the company’s ESG agenda hampers its ability to deliver a maximum return on investment (ROI) for its shareholders. Given BlackRock’s substantial influence in the investment management industry, state-level officials describe the firm’s wholesale commitment to leftist ideals as antidemocratic, irresponsible, opportunistic and possibly even illegal under various state laws.

“Rather than being a spectator betting on the game,” the AGs write, “BlackRock appears to have put on a quarterback jersey and actively taken the field. As a firm, BlackRock has committed to implementing an ESG engagement and voting strategy across all assets under management, and held over 2,300 company engagements on climate, the most of any category of engagement.”

Target: Firearm Industry

The firearm industry is no stranger to corporate liberalism run amuck. The past few years saw some of the nation’s largest banks and financial institutions generate “woke” policies targeting firearm and ammunition manufacturers. Specifically, JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo have all adopted discriminatory policies unfairly denying financial services to firearm-related businesses simply because they don’t like the overwhelmingly popular firearms that these American companies lawfully make. Like Blackrock, these banks have shirked their fiduciary responsibilities in favor of pressuring legal firearm manufacturers to not make, for example, Modern Sporting Rifles (MSRs). The audacity for these companies to circumvent current law and roleplay as an elected lawmaker is as astounding as it is insulting.

Even more recently, credit card companies American Express, Mastercard, and Visa announced in September that they would implement a new merchant code that singles out individuals who make a purchase at any Federal Firearms Licensee (FFL.) A lot of Republicans and those in the firearm industry recognize this for what it is: financial institutions with woke boardrooms carrying water for progressives who are perfectly happy to vilify legal gun owners and American businesses through a “big brother” style surveillance operation.

Dedicated AG’s who sent the letter to Larry Fink, those state officials that make up the SFOF, and politicians like U.S. Sen. Kevin Cramer (R-N.D), who introduced the Fair Access to Banking Act, are making strides in fighting back against ESG and woke corporate boardrooms, but we ultimately need more lawmakers to realize that they cannot let corporations do their job for them and dictate laws to the American public.

You may also be interested in:

States Act to Protect Rights While White House Mulls Gun Control Moves

Categories: Featured, Government Relations, Top Stories