Back to News

Back to News

October 20, 2025

2A Rights Face a New Threat: Ideological Gatekeeping by Crypto Companies

Congress recently passed the GENIUS Act, a measure designed to bring stability and accountability to the digital asset market by providing a legal framework for U.S. dollar–backed stablecoins. Lawmakers wanted to encourage innovation while protecting consumers and reinforcing America’s leadership in financial technology. While Congress debated how to make stablecoins safer and more transparent, one of the industry’s largest players was quietly writing its own rules, creating a system that treats lawful firearm purchases as a prohibited activity.

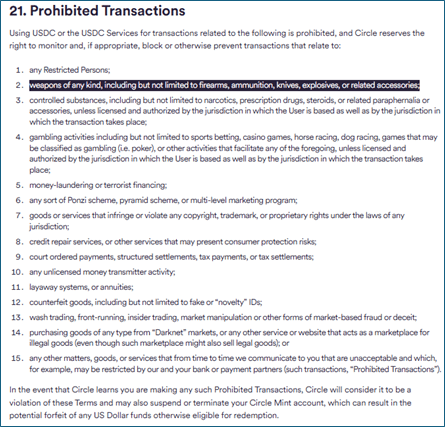

Circle Internet Group, issuer of the U.S. Dollar Coin (USDC), hid a clause deep in its published terms of service that bans consumers from using USDC to purchase “weapons of any kind, including but not limited to firearms, ammunition, knives, explosives, or related accessories.”

This is not consumer protection; it’s ideological enforcement. This is the same sort of financial discrimination that NSSF has fought against and is finally seeing changes with the Trump administration. For America’s firearm owners and retailers, Circle’s rules about how their cryptocurrency can be used should sound alarm bells.

Firearm ownership is a constitutional right. By imposing this blanket prohibition, Circle is effectively inserting its own political views into the marketplace and restricting lawful consumers and businesses from exercising their rights guaranteed under the Second Amendment. This isn’t a question of public safety or financial integrity; it’s a matter of principle. And in this case, those decisions reflect clear political leanings. Circle’s Chief Executive Officer, Jeremy Allaire, is a major donor to Democratic candidates and causes. Federal Election Commission records show that Allaire has contributed thousands of dollars to Democratic state parties and members of Congress, including U.S. Rep. Jake Auchincloss (D-Mass.), a staunch supporter of gun control legislation. While private citizens are entitled to their political opinions, those opinions should not dictate whether Americans can exercise their Second Amendment rights within the digital economy.

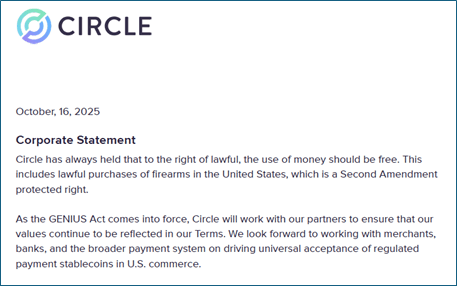

Circle Responds

Circle provided NSSF with a statement attempting to clarify their position. It appears to [have] been a rushed statement given the grammatical error in the first sentence. Their statement came shortly after NSSF posted on X about Circle’s policy.

While it appears that Circle is willing to revisit its policies, as former President Ronald Reagan wisely said, “Trust, but verify.” The firearm industry has seen far too many examples of financial institutions and payment processors quietly introducing “risk management” policies that end up discriminating against lawful firearm businesses and owners. Circle’s statement is encouraging, but words alone are not enough. The proof will be in the policy changes – and in whether those changes ensure that Second Amendment commerce is treated fairly within the digital economy.

A Broader Concern

This episode underscores a broader trend of ideological enforcement creeping into financial services. Americans have long accepted that payment providers must comply with laws against fraud, money laundering and terrorism. But prohibiting the purchase of lawful products like firearms, ammunition or knives goes far beyond those legal requirements. It signals a growing willingness among powerful corporations to decide what Americans can buy and who is “worthy” of financial access.

The Stakes for Digital Finance

Stablecoins like USDC are emerging as a significant component of modern financial infrastructure. As digital payments evolve, decisions made by a handful of private executives – often buried in the fine print – could soon determine which products or industries are allowed to exist in the digital economy. If this is what a private company can do today, imagine the reach of a government-issued Central Bank Digital Currency (CBDC). A digital dollar could enable future administrations to track and restrict transactions nationwide, embedding ideological filters into the monetary system itself.

Every American should be free to spend their lawfully earned money on lawful products using the payment methods of their choice. Whether through bank regulators, payment processors or crypto platforms, Americans must remain vigilant against efforts to choke off lawful commerce under the guise of “risk management” or “reputational risk.” NSSF will continue to monitor Circle’s actions closely. The company’s willingness to revisit its policies is welcome—but as with any issue touching on fundamental rights, trust must be earned and verified.

Freedom cannot survive if your financial tools are turned against you and your Second Amendment rights.

You may also be interested in:

Gov. Newsom Pulls Trigger on Striker-Fired Handgun Ban in California

Categories: BP Item, Featured, Government Relations, Top Stories